Income Ideas for Retiring Early – Part 1

Has the new world thanks to COVID 19 moved up your retirement date? Perhaps it’s time to exchange your paycheck for play checks and retire sooner. It may be time to retire early and you deserve it. Are you confident you can spend with confidence in retirement?

Overview

Before COVID-19 came along, people over age 55 represented 25% of the American workforce. There were more workers over age 55 than under age 30.2 In the course of just a few months, that ratio reversed. While older Americans have proved more susceptible to the ravages of this virus, younger people are willing to stay in the workforce. Even if they’ve had hours reduced or been laid off, they are seeking and plan to resume work in the future.

That future is not so rosy for more mature workers. We don’t know what the normal, onsite work environment will be like a year from now. If the public is still social distancing, that means people are still at risk — and those age 55 and older may not want to take chances with their health. After all, they’ve been saving for decades. They’re not about to miss the opportunity to enjoy retirement just to eke out a few more years of work in an environment fraught with health risks.

“Based on past experience, the longer the situation continues, the more severe the issue of discouraged workers and early retirements.”

— Michael Weber, finance professor

University of Chicago’s Booth School of Business3

Unfortunately, not everyone is in a position to retire right now, at least not the way they originally planned. If you find yourself considering early retirement, do a little prep work to see how feasible it is and what you’re willing to do to make it work. To get started, consider these steps:

- Calculate your annual retirement income needs.

- Calculate your net worth based on current assets and liabilities.

- Check out your (and your spouse’s) level of Social Security benefits based on different ages you can begin drawing them.

- Estimate how much savings you need to have for the latter stages of retirement, such as the for the cost of long-term care assistance.

- Consider if you need to keep a portion of your portfolio invested for long-term growth.

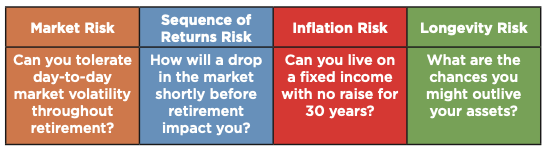

- Consider your appetite for various forms of risk, including market volatility, sequence of returns, inflation and outliving your money.

Think about the obvious sources of income, such as Social Security benefits, a pension, your retirement accounts and investments. However, also consider other potential sources, such as real estate, an inheritance or other income-generating investments.

Bridge Income

For some people, retiring early will require a strategy for providing bridge income until you can pursue your original retirement income plan. Unfortunately, that may mean tapping assets that will reduce your nest egg. However, there are ways to avoid depleting assets, or at least eliminating early withdrawal fees attached to retirement accounts.

Traditional IRA: 72(t)

If you retire before you’re eligible for Social Security and Medicare benefits, the IRS allows backdoor access to traditional IRA assets without paying the 10% penalty tax on distributions taken before age 591⁄2. It’s called the 72(t) provision, and it permits IRA owners to take Substantially Equal Periodic Payments (SEPP) for five years or until you reach age 591⁄2, whichever comes later. Note that you must select from one of three options available (required minimum distribution, amortization or annuitization) to calculate the periodic amount of your 72(t) payments.4

401(k): Rule of 55

Another option is the Rule of 55, which allows you to tap your 401(k) or 403(b) plan without an early withdrawal penalty. This provision has specific qualifying criteria, one of which is if you are between the ages of 55 and 591⁄2 and have been laid off, fired or quit your job. The Rule of 55 applies only to the retirement plan sponsored by your most recent employer, not any prior plans where you may have assets.5

Bear in mind that both of these tactics have eligibility requirements and limitations, and income taxes are due on all withdrawals (they avoid only the early withdrawal penalty). However, these are examples of options to tap retirement money to help bridge income until you qualify for other benefits.

Social Security: Start and Stop

There are a couple of lesser-known Social Security provisions that can help an early retiree who just needs some bridge income to get his or her assets in order. This may be particularly useful if you are expecting an influx of money from, say, an inheritance. If you need to draw Social Security before your full retirement age, you can start receiving checks and then change your mind later. However, you have only up to one year to halt your benefits, at which point you must then repay all the monies received. You may do this only once in your lifetime, but the good news is that your benefit level will continue to accrue until you apply again.6

Social Security: Start and Suspend

If you don’t qualify to stop benefits because you’ve been drawing them for more than one year, there is another option. Once you reach full retirement age, you may voluntarily request to suspend Social Security payouts until up to age 70. By doing this, your benefits will start earning delayed retirement credits that can help boost the income you lost out on because you started taking benefits early. This might be a good option if your portfolio starts providing a high-level income that renders your Social Security benefits unnecessary. Be sure to keep paying your Medicare premiums, however, as they will no longer be deducted from your suspended Social Security benefits. Be aware, too, that if your spouse’s benefit is derived from your employment record, it also will be suspended.7

Work Prospects Down the Road

This pandemic won’t last forever. If you use one or more bridge income strategies now, you might consider going back to work in a few years to help reboot your nest egg. You can retire again later on.

Fixed Income

Real Estate

Real estate rentals present a higher risk now, but if you pre-qualify prospective tenants based on their credit score and their level of pandemic- and recession-resistant occupations, being a landlord can provide reliable income. Be sure you can sustain periods of no income should tenants not be able to pay rent. And, if you have the latitude and are willing to work out payment plans, you’re more likely to secure long-term tenants who appreciate your loyalty and flexibility. If you don’t want the hassle of becoming a landlord, you can hire a management company, but expect to pay about one month’s rent for the annual management fee.

Note that owning rental properties offers tax advantages and the potential for appreciation over time. This may be a good long-term investment option to help pay for health and long-term care expenses later in life. You could sell the property for cash or house a caregiver in exchange for services. If you don’t end up needing the money, real estate can provide a growing asset you may leave heirs tax free, assuming your net worth is below the current $11.58 million threshold ($23.16 million for married couples). As with other assets, the cost basis of real estate inherited by heirs is stepped up to current value at the time of the owner’s death.8

2 Ibid.

3 Ibid.

4 Dana Anspach. The Balance. Dec. 10, 2019. “How to Use 72(t) Payments for Early IRA Withdrawals.” https://www.thebalance.com/how-to-use-72-t-payments-for-early-ira-withdrawals-2388257. July 6, 2020.

5 Melissa Phipps. The Balance. June 28, 2020. “What Is the Rule of 55?” https://www.thebalance.com/what-is-the-rule-of-55-2894280. July 6, 2020.

6 Social Security Administration. 2020. “Withdrawing Your Social Security Retirement Application.” https://www.ssa.gov/benefits/retirement/planner/withdrawal.html. Accessed July 2, 2020.

7 Social Security Administration. 2020. “Suspending Your Retirement Benefit Payments.” https://www.ssa.gov/benefits/retirement/planner/suspend.html. Accessed July 2, 2020.

8 Ashlea Ebeling. Forbes. Nov. 6, 2019. “IRS Announces Higher Estate and Gift Tax Limits for 2020.” https://www.forbes.com/sites/ashleaebeling/2019/11/06/irs-announces-higher-estate-and-gift-tax-limits-for-2020/. Accessed July 15, 2020.

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.