Welcome to Ross Wealth Advisors, your trusted partner in achieving an abundant retirement. As independent advisors, we prioritize your unique financial goals and tailor personalized solutions to secure your financial future. At Ross Wealth Advisors, we believe in the power of active listening, understanding your aspirations, and crafting a roadmap that aligns with your dreams. Our commitment doesn't end there; we are constantly learning and staying up-to-date with the latest industry trends to equip you with the knowledge and strategies needed to overcome any obstacles that may arise on your journey to retirement success. Discover the difference of a dedicated team that truly cares about your financial well-being at Ross Wealth Advisors. Your abundant retirement awaits!

WHY CLIENTS CHOOSE US

Experience the Ross Wealth Difference

We combine personalized planning, attentive guidance, and up-to-date strategies to help you retire with clarity, confidence, and a strong financial foundation.

Trusted Partner

Count on a team that puts your best interests first, building long-term relationships based on trust, transparency, and unwavering commitment to your retirement success.

Tailored Solutions

Your goals are unique—so is our approach. We develop strategies that reflect your values, lifestyle, and long-term financial objectives for true retirement alignment.

Active Listening

We take time to hear your story, understand your aspirations, and address your concerns—ensuring every recommendation is grounded in what matters most to you.

Strategic Roadmap

Our custom retirement roadmap outlines a clear, step-by-step path that evolves with your life, giving you direction and confidence at every financial milestone.

Up to Date

We stay informed on the latest financial trends and regulations so your plan is current, compliant, and optimized for today’s ever-changing economic landscape.

RETIREMENT PLANNING THAT WORKS

Secure Your Future with the ARMOR UP™ Retirement Framework

Our comprehensive planning system helps you preserve wealth, reduce risk, and prepare for life’s uncertainties—so you can retire with clarity, confidence, and peace of mind.

Asset Transfer & Estate Planning

Ensure your assets are protected and efficiently transferred to loved ones. Create a legacy plan that honors your wishes and minimizes probate delays and estate taxes.

Risk Management &

Your Investments

We evaluate market risks and align your investments with goals, using diversified strategies to preserve capital and support long-term financial resilience.

Medical, Health &

Long-Term Care

Prepare for rising healthcare costs with customized long-term care planning. Protect your savings while ensuring access to quality care as your health needs change.

Outstanding Tax Liabilities

Reduce tax burdens in retirement through strategic planning. We help you identify, plan, and minimize potential tax liabilities to maximize retirement income and estate value.

Retirement Income Planning

Create reliable income streams from multiple sources. We help ensure you won’t outlive your money by designing a plan aligned with your lifestyle and needs.

LEARN HOW TO

Live an Abundant Retirement

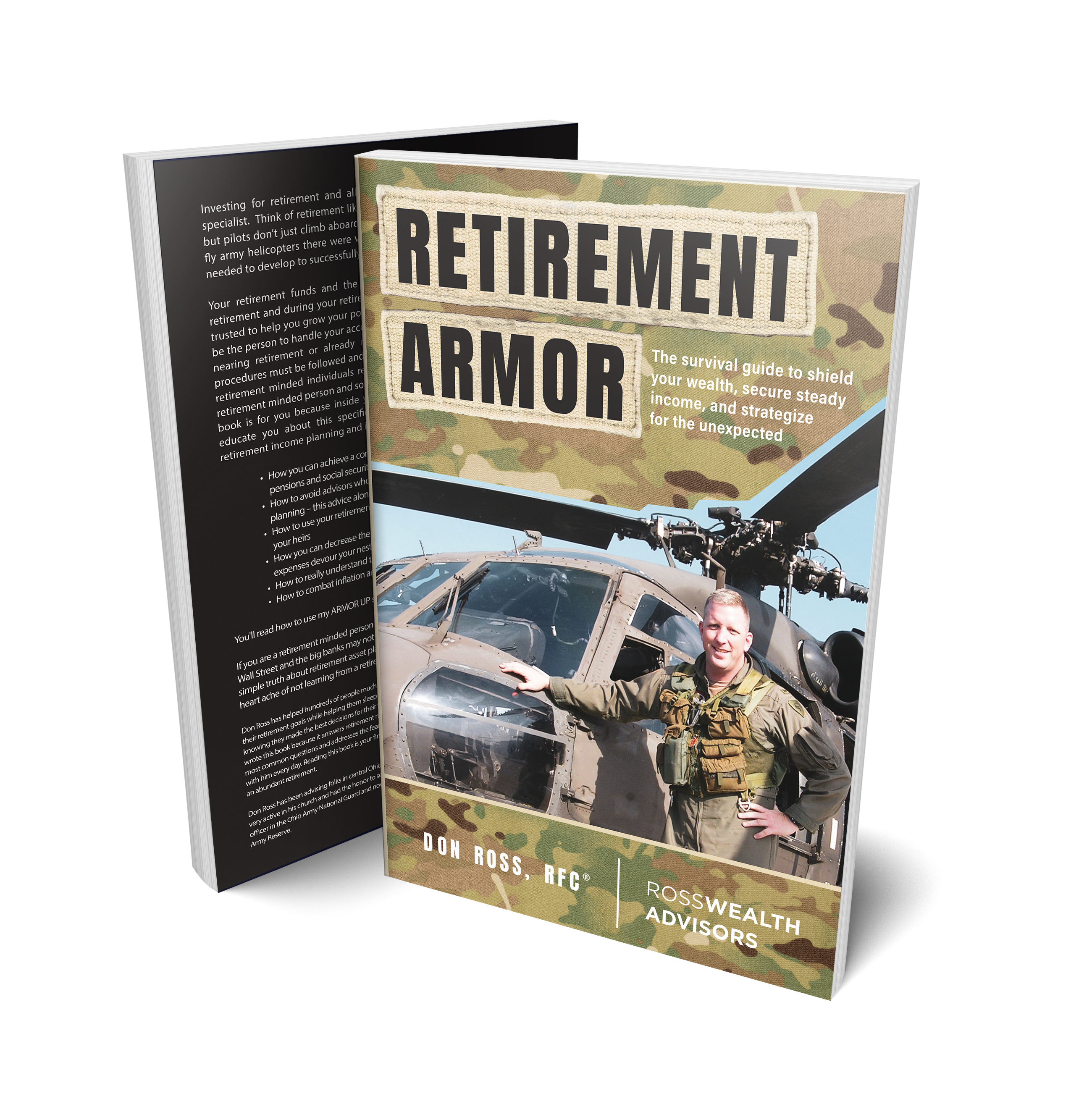

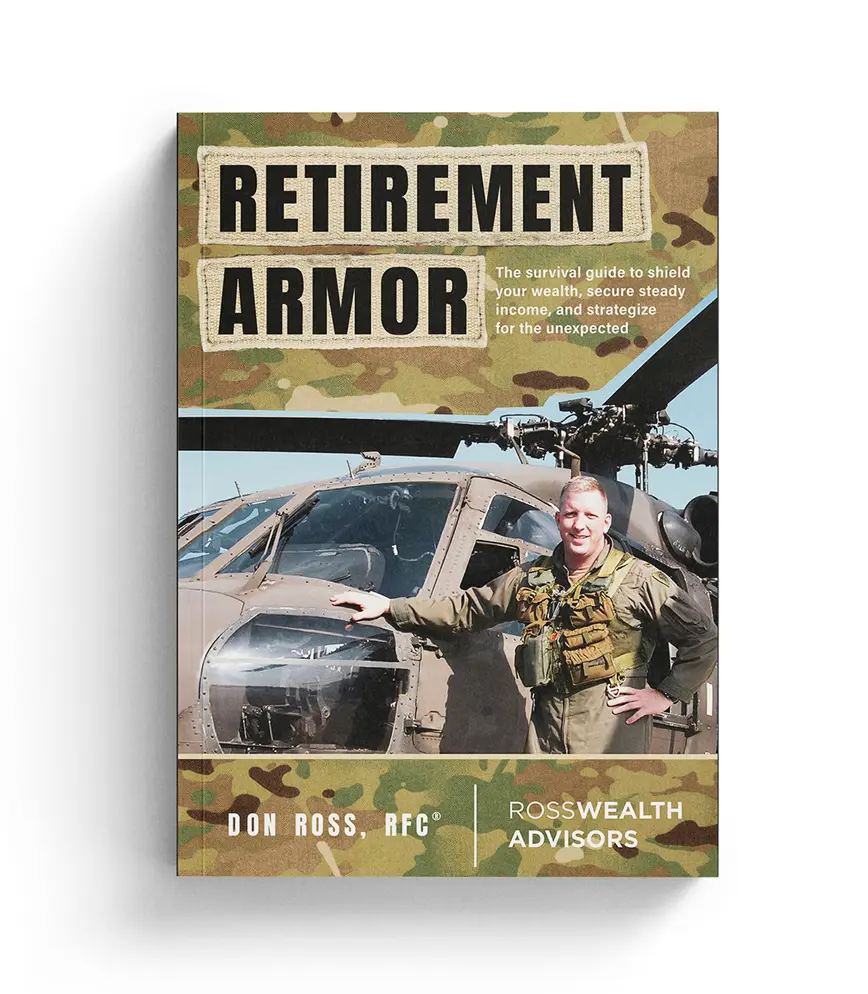

Just like aviation requires specialized pilots, retirement planning demands a specialist. Your retirement funds and allocation strategies need a knowledgeable hand to navigate this crucial phase. While your trusted stockbroker served you well during high earning years, retirement-minded individuals require tailored processes and skills. Introducing our book, your essential guide to retirement income planning. Inside, you'll discover:

If you are retirement-minded, this book will reveal truths Wall Street and big banks may not want you to know. Get expert insights on retirement asset planning and avoid the heartache of not learning from a specialist.

“As an independent advisor, I don’t answer to a bank, brokerage firm or insurance company.

I answer to you.”

DON ROSS, RFC® Founder & President

Frequently Asked Questions

Let's Talk About Your Retirement

Retirement planning is complex—Ross Wealth Advisors makes it simple with personalized guidance. Schedule your complimentary visit today.