Year-End Guide to Financial Planning

Year-End Thoughts From Don

With all that has transpired in 2020, there are several new laws and exceptions included in this financial planning guide that may impact your current tax strategy. With the nation’s deficit expected to exceed 3.3 trillion this year, we anticipate taxes will go up. Due to the SECURE Act and CARES Act in addition to other pandemic relief efforts, you may find you need to adjust your tax strategy to align with your investment strategy.

If moves need to be made to mitigate taxes, now is the time.

Overview

As we head toward the end of 2020, deadlines are fast approaching to implement various tactics that have the potential to benefit your financial portfolio. Because of the many unusual events of this year, your goals may have fallen off track. This report offers an overview of standard year-end strategies, plus some new ones resulting from crisis legislation and opportunities in the economic landscape.

Investment Portfolio

It’s the time of year to harvest investment gains and losses to balance your asset allocation strategy and help minimize your tax burden. If you are planning to sell investments to realize losses (and offset gains on your tax return), be sure to consult with a tax advisor as well as your financial advisor and make sure these transactions are fully completed by year-end.

If you are interested in repurchasing any of those positions that may have dropped in price, be aware of the wash sale rule. This is when an investor buys a “substantially identical” security within 30 days of a loss sale. This action will reduce the amount of loss the investor can claim on his or her taxes, even if the subsequent purchase lands in the new year. It’s also possible for reinvestment purchases from dividend and capital gains distributions to violate the wash sale rule, so you may need to monitor this activity.

One way to avoid a wash sale is to purchase more of the security while the price is low and then wait 31 days to sell the original position to realize those losses. Note that an investor has to do this at least a month before the end of the year to count those losses on his or her 2020 tax return.

When capital losses exceed capital gains for the year, an investor may claim up to $3,000 to reduce taxable income and even carry over remainder losses on next year’s tax return.1

Retirement Accounts

If you haven’t maxed out your 401(k) plan yet, you can defer up to $19,500 ($26,000 if you’re age 50 or older) from your paycheck in 2020. The last deferral comes out of your last full paycheck of the year. However, if you are self-employed and own a solo 401(k) plan, you may continue to make the employer portion of contributions (25% of compensation up to $37,500) until tax day, April 15, 2021.

The combined 2020 limit for traditional and Roth IRAs is $6,000, or $7,000 if you’re age 50 or older. Contributions for 2020 may continue to be made until April 15, 2021. For the 2021 tax year, there is no change to the employee deferral contribution limits for 401(k), 403(b), 457 plans or IRA contributions.2

Tip

The nation’s deficit is expected to exceed $3.3 trillion this year, according to the Congressional Budget Office.3 Relative to the size of the U.S. economy, that is the highest the deficit has been since World War II. This means there’s a good chance taxes will increase sometime in the near future. With this in mind, consider whether it would be better to max out a Roth IRA these days, while taxes are low. In the future, if taxes go higher, tax-deferred contributions to traditional IRAs and 401(k)s may be more valuable.

Also consider whether it would be wise to go ahead and convert at least some traditional IRA funds to a Roth now, to alleviate a larger tax burden in retirement. Just be wary not to tip your current income into a higher income tax bracket with a conversion.

Please remember that converting an employer plan account to a Roth IRA is a taxable event. Increased taxable income from the Roth IRA conversion may have several consequences, including (but not limited to) a need for additional tax withholding or estimated tax payments, the loss of certain tax deductions and credits, and higher taxes on Social Security benefits and higher Medicare premiums. Be sure to consult with a qualified tax advisor before making any decisions regarding your IRA. It is generally preferable that you have funds to pay the taxes due upon conversion from funds outside of your IRA. If you elect to take a distribution from your IRA to pay the conversion taxes, please keep in mind the potential consequences, such as an assessment of product surrender charges or additional IRS penalties for premature distributions.

New

Recent legislation has made it possible to keep contributing to a traditional IRA as long as you are earning income. Previously, investors were prohibited from contributing past age 70½. Roth contributions still have no age limit.

Families that have been directly affected by COVID-19 may be able to withdraw up to $100,000 penalty-free from a retirement plan to help make ends meet. However, this option only runs to the end of the year, so you don’t have much time left.4 Furthermore, the income taxes on these distributions can be spread out over a three-year period, or you can recontribute the funds over the next three years to avoid having to pay those taxes.

Retirees are not required to take retirement account minimum distributions this year, but it might be prudent to go ahead and do so if you expect to be in a higher tax bracket in the future.

Education Savings Accounts

There is no annual deadline or contribution limit for a 529 college savings plan. However, where available, various states limit the amount you can deduct on a state tax return. Some folks like to make a year-end gift to a child or grandchild’s 529 plan as an annual gift-tax exclusion. Individuals may gift up to $15,000 ($30,000 for married couples) per beneficiary without incurring gift taxes or affecting their lifetime gift tax exemption ($11.58 million).5 This is a viable way of helping out the student while removing taxable assets from their estate.

New

Many colleges cut their semesters short or reduced tuition when classes moved strictly online. Some of them even issued partial refunds. For families who paid that money out of a 529 plan, any refunds need to go back into that account. Otherwise, these families may be liable for taxes and penalties for a non-qualified distribution — seeing how that refund was probably used to pay for other things.

Another new feature of 529s is that they now allow qualified expenses to include student loan payments, up to $10,000 for the beneficiary and an additional $10,000 for each sibling. Expenses associated with a registered apprenticeship program are also eligible.

Health Care Savings Accounts

If you have a Health Savings Account (HSA), the deadline for contributions isn’t until April 15, 2021. However, if you have a health Flexible Spending Account (FSA), remember that those funds are generally use-it-or-lose-it by the end of the year, unless your employer offers a carryover amount or grace period. One strategy is to use those funds by year-end to buy things like first aid kits, bandages, contact lenses and eye exams. You can check out IRS Publication 502 for other types of allowed medical expenses.

If you had an overage or shortage of FSA funds this year, plan to adjust your 2021 contributions accordingly.

New

As of this year, account owners can use HSA or FSA funds to pay for over-the-counter drugs.

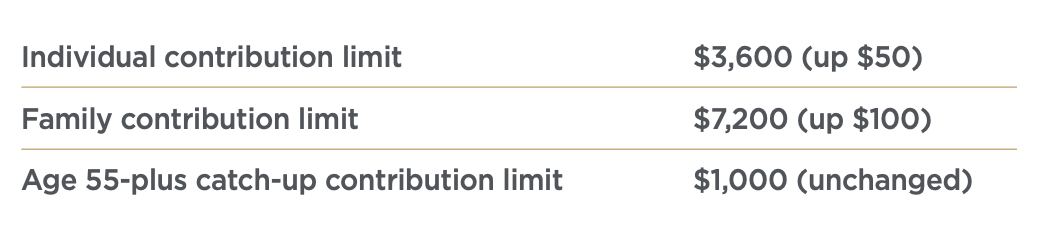

Starting in 2021, there is a slight increase in contribution limits for HSA plans:6

Charitable Donations

The holiday season is a great time to donate to charities. One option is to gift stocks with long-term appreciation, which may offer a substantial contribution to the charity while the donor avoids paying capital gains taxes. Investors over age 70½ can donate up to $100,000 from their IRA through direct, tax-free transfers to qualifying charities, which also satisfies minimum distribution requirements (although not required this year).

New

Pandemic legislation passed in 2020 allows taxpayer gifts made to qualifying charities to be deducted in addition to the standard deduction, up to $300. Or, you can elect to deduct cash contributions up to 100% of 2020 adjusted gross income on an itemized tax return.

“You may find that you need to adjust your plan based on recent legislation, such as the Setting Every Community Up for Retirement Enhancement (SECURE) Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act stimulus package.” 7

Final Thoughts

Keep an eye out for possible tax law changes going forward. This report offers an overview of what to expect when filing your 2020 return, but be alert to how changes in the coming year could impact your situation. For example, it may be prudent to hold off on potential tax deductions for this year’s return. They may be more useful next year.

With that said, be sure that your tax strategies do not disrupt your investment strategy. Coordinate with experienced professionals to align your tax planning with your long-term financial goals.

Don’t go it alone!

Speak with a financial professional who can give you an objective viewpoint on the items presented in this financial planning guide and how best to protect your portfolio. Schedule an appointment with Don today to get started!

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.

2 Timothy P. Brechtel and Michael C. Seibert. National Law Review. Oct. 26, 2020. “IRS Releases 2021 Benefit Plan Limits and Thresholds.” https://www.natlawreview.com/article/irsreleases-2021-benefit-plan-limits-and-thresholds. Accessed Oct. 26, 2020.

3 Jonathan Nicholson. Marketwatch. Sept. 2, 2020. “U.S. budget deficit to hit record $3.3 trillion this year, CBO says.” https://www.marketwatch.com/story/u-s-budget-deficit-to-hitrecord-3-3-trillion-this-year-cbo-says-11599070944. Accessed Oct. 26, 2020.

4 IRS. Sept. 19, 2020. “Coronavirus-related relief for retirement plans and IRAs questions and answers.” https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-andiras-questions-and-answers. Accessed Oct. 26, 2020.

5 Kathryn Flynn. SavingForCollege.com. Oct. 19, 2020. “529 Plan Contribution Deadlines.” https://www.savingforcollege.com/article/529-plan-contribution-deadlines. Accessed Oct. 26, 2020.

6 Timothy P. Brechtel and Michael C. Seibert. National Law Review. Oct. 26, 2020. “IRS Releases 2021 Benefit Plan Limits and Thresholds.” https://www.natlawreview.com/article/irsreleases-2021-benefit-plan-limits-and-thresholds. Accessed Oct. 26, 2020.

7 Wells Fargo Advisors. Sept. 7, 2020. “Your Year-End Financial Checklist.” https:// privatebank.wf.com/conversations/year-end-checklist-2/. Accessed Oct. 26, 2020.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.