Understanding Fixed Index Annuities

A Guide to Understanding the Advantages and Costs of Fixed Index Annuities (FIAs)

If you’ve started thinking about creating income for retirement, chances are you’ve heard about annuities.

Annuities are used to create income to help individuals maintain their desired lifestyles after their regular paychecks cease. While there are several types of annuities, all designed to provide income in retirement, fixed index annuities have a higher potential for growth without being directly exposed to the stock market.

This guide is designed to help you better understand fixed index annuities so you can determine whether they may be a good fit for your overall financial strategy.

What is an annuity?

To understand fixed index annuities, it’s important to first understand what exactly an annuity is and the various types that are available.

Broadly defined, an annuity is a contract between you and an insurance company where the purchaser pays a premium in exchange for a variety of guaranteed payout options for a set period of time or for the remainder of his or her life.

The two phases of annuities are the accumulation phase, where the contract value accumulates interest earnings, and the distribution phase, where income is paid out from the annuity.

Annuities are insurance contracts. They are different than savings accounts, investments and other types of insurance policies because they are the only financial product that can guarantee income as long as you live. The guarantees of an annuity are backed by the financial strength and claims-paying ability of the issuing insurance company.

Types of Annuities

There are two categories of annuities: immediate and deferred. With immediate annuities, the insurance company provides a series of guaranteed payments that begin right away. With deferred annuities, you make one or multiple payments over a longer period of time, allowing your premium to accumulate interest.

There are three types of deferred annuities: fixed, variable and fixed index.

While traditional fixed annuities provide a steady, guaranteed interest rate for a specific number of years, variable annuities can possibly provide higher growth on your premium — at the cost of greater risk. Fixed index annuities (FIAs) combine some of the characteristics of both.

What are the basics of FIAs?

In an age when the responsibility for funding retirement is shifting more to the individual and further away from employer pensions and government programs like Social Security, fixed index annuities offer a solution for generating reliable retirement income. FIAs are attractive to those preparing for retirement because of the principal protection they provide and the potential to earn higher interest than other financial vehicles — in other words, you can get some of the benefits of the stock market without as much of the risk.

How Fixed Index Annuities work

An FIA earns interest on your principal, up to a certain amount, that is based on an external market index, such as the S&P 500. When you buy an FIA, you do not own any shares of stock or participate directly in the stock market. Rather, you own an annuity contract.

FIAs credit interest to your annuity based on a formula (determined by the insurance company and outlined in your contract) that decides how additional interest from the index is calculated and credited to your contract value.

While the core benefit of fixed annuities is guaranteed interest credited to your principal and the core benefit of variable annuities is the potential for higher growth, FIAs offer protection of principal from market losses, but they also have the potential to provide higher interest earnings than traditional fixed annuities.

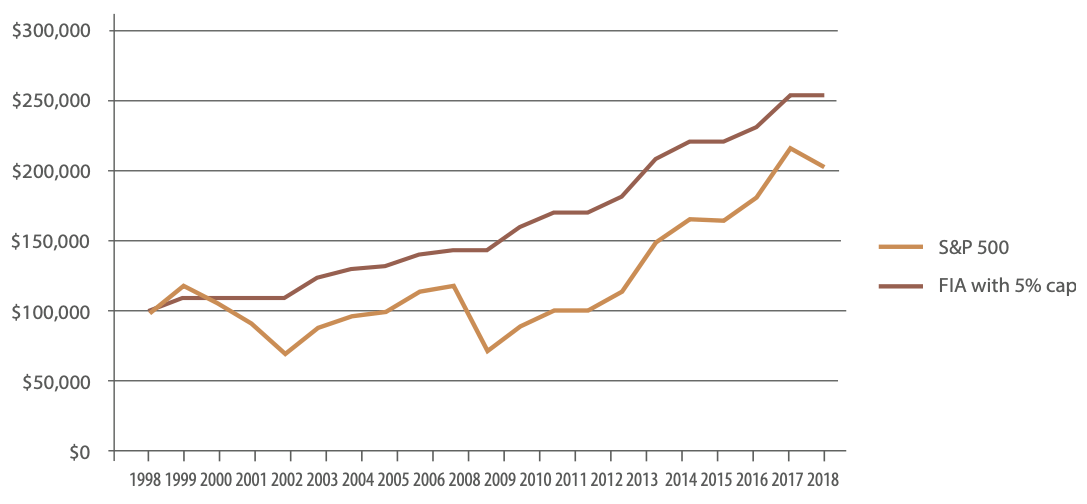

Using the S&P 500, this chart illustrates a hypothetical scenario of how an investment of $100,000 would have performed if invested in the stock market versus through purchasing a fixed index annuity. In this scenario, the FIA had a 50 percent participation (par) rate, meaning that if the market performed at 10 percent growth, the money the FIA owner allocated to that indexing strategy would earn 5 percent interest.

Notice that in the economic downturn in 2008, the S&P 500 dropped significantly, from approximately $119,500 to $73,500, while the FIA stayed flat. So while it didn’t gain any additional interest that year, it also didn’t lose any principal or previously gained interest due to market losses.

If you’re looking to guarantee a portion of your retirement income, an FIA may be worth considering.

FIA vs. Stock Market Performance in a Volatile Market

This hypothetical example is for illustrative purposes only, should not be deemed a representation of past or future results and is no guarantee of return or future performance. This example does not represent any specific product and/or service. A FIA with 50% par rate is for illustrative purposes only.

Could an FIA be right for you?

If you’re thinking about purchasing an FIA, here are a few questions to ask yourself:

- What is your goal for the principal you are using to purchase your annuity? Protection from the market? Growth? Both?

- How much risk are you comfortable with?

Additionally, there are several potential costs and limitations to think about before

purchasing an FIA:

- Surrender Charges: The premium you use to purchase an FIA is not liquid, meaning you may not be able to withdraw it from the annuity without incurring surrender charges, which are penalties levied against withdrawals made before the date stated in the annuity contract.

- Commissions: If you purchase an annuity from a financial professional, that financial professional earns a commission. Commissions are built into the cost of the product and are paid by the insurance company directly to the financial professional.

- Rider Fees: There are various optional riders that you can purchase with an annuity that provide additional benefits. For example, income riders can enhance your lifetime income stream in various ways. However, riders may come at additional costs.

- Caps: A cap is an upper limit put on the maximum interest rate credited over a certain time period. If the index increase exceeds the cap, the cap is used to calculate the credited interest. For example, if the index increases 10 percent but the annuity had a cap of 3 percent, the annuity would be credited 3 percent.

Don’t go it alone!

Trying to figure out the best ways to make your money last in retirement isn’t always as straightforward as it sounds. It’s a good idea to speak with a financial professional who can give you an objective viewpoint on whether an FIA could be a good fit for a portion of your retirement assets within your overall financial strategy. The decision to purchase an FIA ultimately depends on your unique financial situation, risk tolerance and financial goals. Schedule an appointment with Don today to get started!

This content is provided for informational purposes only and is not intended to serve as the basis for financial decisions. Investing involves risk, including the potential loss of principal. Any references to lifetime income generally refer to fixed insurance products, never securities or investment products. Our firm is not permitted to offer tax or legal advice. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). Content prepared by Advisors Excel.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.